In an article in Mauritius Times dated April 2019, I argued that the cost of dismantling the BAI could well reach a final amount of Rs20 bn and that the public will be footing the bill in the coming years, after having been fed with illusions of high returns from the outright sale of NIC, Maubank, Apollo Hospital, and other BAI assets.

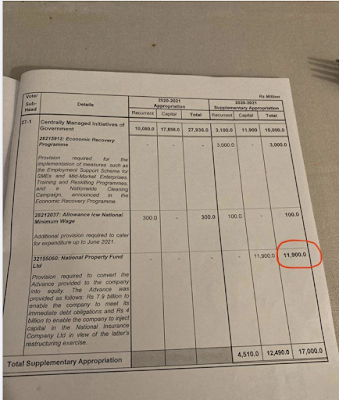

Now Govt is converting the advance provided to the National Property Fund (NPF) as equity amounting to some Rs 12 billion !!! What returns can we expect from these insolvent state companies? The conversion into equity is thus just a subterfuge not to declare the NPF as insolvent. Our money is going down the drain.

Now with such incompetent and irresponsible “vauriens” around, we are worried about the management of our Rs 80 billion by the MIC which does not meet the test of transparency and accountability on the investments and returns !!!

In the National Assembly , Payadachy was queried on the MIC

Question by Hon X.Duval: "Now, these Rs80 billion, is it any of it - can I have a straight answer from him - how much of it is going to go to property developers close to the Government? How much of it is going to go to lame ducks close to Government and to him? How much of it is going to go to speculative ventures because people are close of family members to Government Ministers, Mr Speaker. This we have a right to know."

Reply: "M. le président comme j’ai répondu dans la question, c’est une société privée et il n’est pas approprié de répondre à cette question comme toutes les sociétés privées."

Is our money being properly managed ? I doubt it with Lord Desai, as Chairman of the MIC -now past 80 years old, partially deaf, who has no knowledge of the local situation and the political connections and who do not seem to be quite conversant with the nitty-gritty of investments and projects , and he is only intervening by video conference!!! And we have a certain Mr Yousouf Ismaël, a crony of the regime, who has recently been investigated by ICAC about a certain deal when he was at the CWA !!! Is our money in safe hands? Or is it another waste of public funds ?

In an IMF note entitled “Unconventional Monetary Policy in Emerging Market and Developing Economies(EMDEs)” by David Hofman and Gunes Kamber, the authors warn about the risks of central banks creating special purpose vehicles to extend direct credit to the private sector. (like MIC set up by BoM)

‘Central banks in some EMDEs may additionally consider providing direct credit to nonfinancial firms. However, such lending could easily lead to credit misallocation, especially in countries particularly prone to connected lending and political-economy distortions. As highlighted in the previous section, it is generally also not desirable for central banks in EMDEs to take on substantial credit risk, and direct lending faces many associated governance challenges (for example, difficulty reversing such policies and compromising central bank independence). Therefore, such a policy will be generally undesirable except in dire circumstances. In any event, support should aim at solvent firms. Indeed, equity injections by the government, rather than loans from the central bank, may be needed to tackle insolvency, and the fiscal costs and risks should be properly recognized. Moreover, given that it is difficult to determine whether firms are insolvent or illiquid at the time of the crisis, the governments should be ready to help cover potential credit losses to central bank balance sheets arising from any such support schemes.