Rattan Chand Khushiram, an avid contributor on economic issues, better known under the pen-name RChand. Headed the Economic Analysis and Research (EARS) unit of the ex-MEPD and was till recently, Director of the Research and Sustainability Division (ReSD) at the Ministry of Finance and Economic Development (MOFED)

Friday, January 25, 2013

Titbits: Depreciation of the Rupee; Wrong timing - The trip to Maldives; Quality institutions make a difference; Tablets for Form IV -a Challenge; Disciplining the medium.

Depreciation of the Rupee.

The IMF report ‘Mauritius External Balances from a Long-Term Perspective – May 2012’ notes that “… using cross-country panel methodologies as well as single country time series techniques, we estimate that the Mauritian Rupee is mildly overvalued with respect to fundamentals. Nevertheless, there is significant uncertainty about the size of the overvaluation.” And recent data on real exchange rate show that between 2007 and 2011, the real effective exchange rate (REER) appreciated by 18%; in 2010 and 2011, it appreciated by 3.2% and 6.2% respectively.

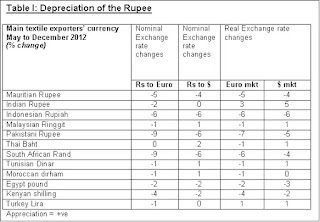

Moreover a comparative analysis of the textile producing countries shows that we are among the countries whose currency has depreciated markedly against the Euro and the dollar over the second semester of 2012. Even in real terms, the rupee has depreciated significantly -- around 4-5% -- preserving to some extent our external competitiveness vis-à-vis some of our immediate competitors, especially some African and Mediterranean countries which have seen a lower depreciation in their currencies. The depreciation of the Rupee has boosted the competitiveness of some enterprises and their profitability and given a little fillip to the economy in the third and fourth quarters

The Bank of Mauritius (BOM) preference for control of inflation over growth keeping a long-term perspective in mind has been a well laid down policy tool that has successfully dented inflation and anchored inflationary expectations. The exporters’ skilful lobbyists, however, has been complaining that the appreciation of the rupee was adversely affecting the country’s external competitiveness. As industry and exporters sought solace, the Ministry of Finance (MOF) seemed to have succeeded in nudging the BOM to consider the depreciation option, or better, realigning the misaligned rupee. The MOF, while not underestimating the need to fight inflation, believed that the BOM monetary stance was throttling growth in a global environment where the country needed to create more jobs and grow faster. (Recall the MOF argument of the additional one per cent of our growth rate foregone as a result of the appreciating rupee.)

But the depreciation of the rupee poses however a potential upside risk to the inflation outlook. The degree of this risk will depend on the extent and persistence of the depreciation trend, which in turn will be influenced by the duration and intensity of global risk aversion, business confidence, global commodity price movements and expected adjustment in retail petroleum prices. It will be interesting to follow the evolution of the exchange rate now that the composition of Monetary Policy Committee is being reconfigured to accommodate the MOF at the cost of the Central Bank–undermining its cherished independence. « Tous les grands pays avaient consenti une autonomie croissante a leur banque centrale pour les dégager de la tutelle des gouvernements : confier la gestion de la monnaie à des politiques, disait-on, c’est donner la clé du bar à des alcooliques. » Will we be seeing, as announced in the 2013 Budget documents, another bout of the short-term, easy way out, policies of unduly relying on a falling rupee to stimulate economic activity without imposing the reforms that would ignite a true revival of the economy?

Wrong timing – The trip to Maldives

Some knowledgeable observers find it inopportune the recent official visit to Maldives of the delegation led by the Minister of Finance coming in the wake of the increasingly tense relations between India and Maldives since the fall of the Mohamed Nasheed government in a coup early last year. The trouble has escalated with the decision of the Government of the Maldives to terminate a 25-year $500 million contract of the Indian infrastructure major GMR-backed consortium to operate and modernize the Ibrahim Nasir International Aiport (INIA). GMR seems to have become a victim of Maldives internal political machinations.

Intertwined with the politics is the growing Chinese influence in the island. Apparently, a few elements in the Maldivian government wanted to push the Indian company out and rope in a Chinese firm instead. Chinese companies are also eyeing the contract to build the Gan International Airport in Adu Atoll, as well as another one closer to India’s Lakshadweep islands. These developments have caused concern in New Delhi. For several months an anti-India climate has been building up in the Maldives. The first public manifestation of this climate was visible when a spokesman of the President’s Office went ballistic against the Indian High Commissioner describing him as “an enemy of the Maldives and the Maldivian people”. New Delhi at one stage had even thought of suspending its annual aid to the Maldives.

The visit to the Maldives was indeed ill-timed. We have to be careful as to how and when we make our moves on the regional chessboard; we have to make sure that we do not tread on some sensitive toes or send the wrong signals. Already India’s prickliness is beginning to show by linking the Comprehensive Economic Cooperation and Partnership Agreement (CECPA) to the India-Mauritius Double Taxation Agreement (DTA) renegotiations. We have to careful when wading onto turf that falls under others’ spheres of influence.

Quality institutions make a difference

The quality of the country’s institutions has stood the country in good stead. They were utilised in productive sectors and in building up the social infrastructure to meet our developmental, social insurance and social assistance goals. One important determinant of growth, that is the ability of our domestic institutions to manage the distributional conflicts, triggered by local and external shocks, stood out markedly in the case of the development of Mauritius. The quality of our domestic institutions appeared to override the other primordial factors affecting our historical development. These institutions ranked well above the average African country with respect to all indices of institutional quality, political as well as economic.

But of late our institutions have been suffering from an ethical and governance deficit. They seem to have repudiated transparency and accountability with a brazen shrug of nonchalance. This is the worst case of effete leadership shown by our institutions. We had created institutions that have stood the test of time because there were men of calibre who manned them; men who went through the grind and made their way up and earned both acceptability and respectability and whose combative honesty were more likely to torpedo their quest for high office. Few of such people are now left in the service. Many of those around today bend so easily with the wind, which explains why a good number of our institutions have lost their sheen and respectability. This, the Mo Ibrahim index on governance will not be telling us.

It is time that our institutions are given greater autonomy and freedom to work independently. Our public officials must he held accountable and answerable. Issues of corruption and abuse of power have to be addressed. Stronger institutions are what the nation will depend on to cement future growth. We need immediate reforms to restore accountability and credibility to our institutions.

We can take an incremental approach starting by: (a) putting in place a transparent nomination process for the directors of boards. The key element of such a process should include developing clear selection criteria, professionalizing the nomination process and enhancing public scrutiny of the results; (b) establishing a framework for performance management. Government needs to develop a framework for communicating government’s expectations to each institution and to the public. The core of the process in most countries is the establishment of a performance agreement; (c) reviewing performance and holding institutions accountable, and (d) establishing performance incentives. E-governance must become the centre stage of our institutions to reduce physical contact and to enhance the quality of the delivery of our public services. This will also minimise opportunities for corruption.

Tablets for Form IV – a Challenge

Today technology is ubiquitous and all-pervasive. The education sector has been slow in adapting to technology. However this is likely to change. Students entering the education system have been born in the technology era and are absolutely comfortable in using technology and will force teachers to rapidly adapt. As families increase their spending on education, the education sector will have to rise to the challenge of providing the accompanying quality applications and softwares to this new technology.

A cheap tablet is useful. But there must be a supporting ecosystem of educational applications and online content, if it is to become a real force-multiplier. The Ministry of Education must tie up with local and foreign content developers to offer packaged educational content. It will have to find ways, instead of relying solely on the MIE, to harness local and foreign vaunted software competencies to fill this need. It also has the onerous task of educating educators, and retraining them to adapt their pedagogic methods to digital environments. Eventually, whatever the outcomes, tablets for Form IV will make a great case study for anybody who wants an insight into the way policy initiatives work or stumble. Right now, all one can do is hope that there are no glitches in the implementation of the project and the scale-up which may spawn more opportunities for technology-based education providers.

Disciplining the medium

Walter Lippmann, the American intellectual, writer, reporter and the author of ‘Liberty and the News’, once said, “ There can be no higher law in journalism than to tell the truth and shame the devil.” In a country of with its enormous mix of newspaper addicts with different penchants and persuasions and where they patiently queue up for their daily dose of the sacred word from their favourite newspapers and still say “It’s out in the papers” to emphasize what they take to be the truth, it will be futile to even dream of disciplining the medium. We, journalists, owe it to them, our readers, to strive to uphold the highest standards of the profession without fear or favour, to tell it like it is. Our commitment is to the excellence in journalism.

One of the best definitions of journalism is: The truth well told. And that’s what many of us are doing.