Revving up economic growth

The latest forecast by some economic analysts of the real growth rate of the Mauritian economy settling down to a slow pace of 3.0 % for 2012 points to a gradual collapse in our growth performance. It is lower than the 3.4 % posted by the Ministry of Finance which seems to have lost some credibility as their growth predictions have continued falling way off the actual figures. But the Mauritian growth has been going off track as its small open economy is being uncoomfotably exposed to the global meltdown. On 9 October, the IMF released its World Economic Outlook which painted a gloomy picture of the global economy.

The IMF warned about the dimming chances of an immediate economic recovery and projected a lower global growth of 3.3 % in 2012 down from the 3.5% estimated earlier. To what extent can we blame the adverse conditions of the global economy for the difficulties of the Mauritian economy ?

A comparison over some different periods shows that we had fared better in the two earlier ones. In the period 2000 to 2005, the economy faced a decline of 24 % in the terms of trade and an explosive increase in the price of petroleum which increased by 2 and 1/2 times over five years while the world economy grew at an annual average rate of 3.8 per cent over the period. Despite the relatively adverse international situation, the September 11 terrorist events, SARS, the geopolitical tensions with the war in Afghanistan and Iraq and the erosion of trade preferences, (end of Multifibre Agreement and the large cut in EU sugar prices announced ) and unfavourable climatic conditions locally, the Mauritian economy had shown remarkable resilience growing at a satisfactory average annual rate of 4.9 %

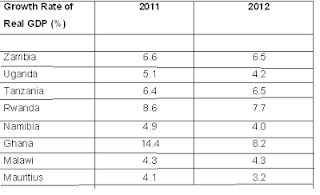

Over the period 2006-12, the terms of trade decline by only 9%, oil prices increased by only 66%, but the growth rate of world output was on average 3.8% annually and that of world tourism at 6%; the Mauritian economy has however grown at annual average rate of 4.3 %. Sub-Saharan Africa registered an annual average growth of 5.3 % over the same period. Most of the African countries have been recording above 4% growth.

|

Thus it seems that much of the slackness in growth is the making of our own policy makers. They had only accelerated a normal cyclical downturn caused by a synchronised global slowdown by their policy paralysis. The forthcoming budget should break free from this policy paralysis, get rid of the sense of stagnation and get on with the task of restoring high growth.- a determined effort to put our foot on the reform pedal to ensure a real change in terms of higher growth, more jobs and lower infaltion. The task of reviving economic growth is an uphill one and we need a sustained effort and not simply a few dramatic measures. The economic reforms juggernaut certainly needs a mighty push in the coming budget. The choking off of 1% of our growth rate as a result of a misaligned rupee is not an issue.( I doubt whether our local and foreign econometricians got it right given that even the IMF were doubtful about the extent of the misalignment of the rupee. It would surely shed some more light on the issue if they could disclose the extent of overvaluation of the real effective exchange rate that they have calculated to be causing such havoc to our growth prospects!! ) The main task as advised by Raghuram G.Rajan, India’s new chief economic advisor, is to combat inflation jointly the Central Bank (CB) and Government- “in which government can help on the supply side because these are real actions .The CB’s attempt is to quell the demand side and so there’s a better match between demand and supply.”

Budget 2013: A better use of Special Funds

In November last when we were commenting on Budget 2012, we expressed our doubts on the possibility of spending the Rs 14.3 billion earmarked as capital spending for 2012 which amounts to around 4.1 % of GDP. This is because of the dismal performance in capital spending since fiscal year 2007/08. As shown in the table below, capital expenditure(exclusive of Special Funds) had averaged a mere 2.3 % over the past four fiscal years.

% of GDP

|

2007/08

|

2008/09

|

2010

|

2011

|

2012(Estimates)

|

Capital spending

|

1.7

|

1.9

|

2.7

|

2.7

|

4.1

|

As at September 2012 only 40% of the total earmarked capital expenditure has been spent. Assuming a shortfall of around Rs 1 billion in revenue and that some 2.6 % of GDP is spent on capital by the end of 2012 , the budget deficit for 2012 works out to be around 3% of GDP. This means that Rs 4 billion will be left unspent in 2012. This could be credited to the 6.2 billion left unspent in the Special Funds. The total amount available in Special Funds for 2013 and later is thus Rs 10 billion .Out of this Rs 10 billion we have to provide for the Rs 3.4 billion for the PRB awards (net of the Rs 1.2 billion recouped by the authorities) if we want to keep a downward trend in our budget deficit figures. Even after allowing for a capital spending of 3.0 % of GDP and with the credit of 3.4 billion from the Special funds, we can at the least maintain the budget deficit at 3% of GDP for 2013. And we will still have some Rs 6.6 billion for budget 2013, enough of “marge de manoeuvre” for a new bold stimulus package for the economy instead of leaving funds idle for years in bank accounts as Special Funds.

Indian Diaspora - Doing business together !!

The Indo-Mauritian relationship is a special one. Both culture and history have coalesced forging singular bonds, assiduously knitted over millenniums, to unfold a unique blend of camaraderie, entente and trust. These have been consolidated by regular exchanges between our two people and frequent visits of high dignitaries. One of the distinguished visitors even eulogised Mauritius as a "Great Little Country". Perhaps she meant that little Mauritius, though not an exact replica of Mother India, had successfully imbued the centuries-old traditions and philosophies of one of the most ancient civilisations in the world. Without the expanse of the Indian sub-continent, extending from Kashmir to Kanyakumari, to imbibe the prodigious legacy of the Indus Valley civilisation, the Harappans and the Indo-Aryans and non-Aryans, little Mauritius could still boast of harbouring the great religions that have peopled the world and of having preserved the purity of traditional culture and the Dharma-moral law. It is perhaps in this sense that the little country became great. The Dharma not only taught us how to live with the mind-boggling diversities of a multi-lingual and multi-cultural nation-state but also to learn to cherish such diversities. Another way that the little country meets the Great is in the shared belief of the outstanding virtue of democracy. Democracy, in both Little and Mother India, has not only survived the vagaries of time but has deepened over the years to establish itself as the only form of political organisation supple enough to accommodate the diversity of our societies. Thus our special relationship goes beyond the emotional ties of the five millennium of a common cultural heritage and legacy. It is rooted in the more concrete practical realities of a trusting partnership sharing a common vision of the local and the global economy and the framework for a comprehensive development agenda for the third millennium.

These links have continuously been affirmed by the valuable and relentless commitment to an informed understanding of the depths of our historical tradition and heritage. The Great Little Country, harbouring the great civilisations of the world, can still boast itself for having preserved the purity of their traditional cultures and values such that the Mauritian today sources himself from East as well as West, equally at ease with stalwarts ranging from Voltaire to Premchand and ensuring that the twain does meet. The organisation of Pravasi Bharatiya Divas here in Mauritius gives a special meaning to the interplay between culture and economics. If globalisation exercises such a hold over the imagination of people as it disseminates its culture of leisure and affluence, it also discloses the importance of cultural ties in boosting trade and investment. In the olden times, culture followed trade through the Silk Route. Now it is working the other way round. The High Performing Asian Economies hooked themselves to the overseas Chinese business networks, the so-called Bamboo Networks, and as India lurches forward with its vast reservoir of “jet-setting globalists”, “high-powered intellectuals” and “high-rolling industrialists”, it will be relying a lot on its own Diaspora to continue to drive it confidently and pertly forward to double digits growth much beyond the stagnant Hindu rate of growth stigma.

Mauritius, a rallying centre among others for the Indian Diaspora, hopes to plug to these types of networks to forge with India a new route - call it the IT/Financial Highways - where Mauritius and the Indian diaspora will interface the sub-continent via the African continent to other growth centres. We believe that our roadmap to economic prosperity remains the close integration of Mauritius in the global economy and the development of Mauritius as a business and financial hub serving the region and beyond. Mauritius could thus act as a service node linked to a huge network of investment ventures stretching all through East Asia, the Indian sub-continent, Africa and other affluent countries of residence of the Indian Diaspora, imposing itself as a packager of investment. There are indeed immense possibilities to encourage outsiders to exploit new investment opportunities and to use other states as platforms for serving the whole bloc. As most of the countries are successfully integrating into the global economy and are taking measures to attract foreign talents, know-how, ideas, technology and capital, and improve their investment climate, it will open opportunities for pooling resources together to tap the global and regional business, trade and investment networks.To galvanise resources, we believe that special measures should be devised to facilitate the involvement of the Indian Diaspora in the investment sector in India and Mauritius. For example, this may include the setting up of special economic zones exclusively for projects to be set up by NRIs/PIOs where the Diaspora could be involved in the development of such zones. It is also important that NRIs/PIOs promote greater bilateral trade and investment relations between their country of adoption and India. The comprehensive economic and partnership agreement between India and Mauritius, which aims at promoting greater trade and investment exchanges, can serve as a powerful conduit for greater bilateral exchanges for mutual benefits.

India’s economic clout is beginning to make itself felt on the international stage as the nation retakes the place it held as a global-trade giant and races to become an economic powerhouse. India is seeing not only a revolution of the economy but also one of the national mindset. We all share with India the hope that goes with a future full of possibilities, especially for the nations and the Indian diaspora that choose to hook themselves to the powerful Indian wagon of growth in business, trade and investment. We believe firmly in the creative energies of the Indian Diaspora. The Pravasi Bharatiya Divas function is a deep expression of an urge by the PIO as well as the NRI to dialogue and interact and to strengthen further the ties of kinship. The reverse brain drain from PIOs and NRIs who have made fortunes globally is already happening as witnessed by many new captains of Indian Industry. We should continue to further promote its propagation through these high level exchanges and conferences to tap our ” mutually beneficial strategic partnership which offers... a highly promising agenda for cooperation between our two countries.”